Share Market Crashes & Dividends

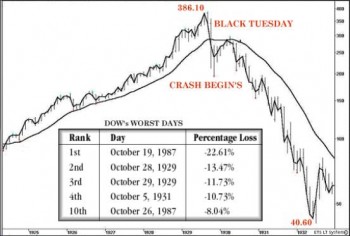

The media speculates every day about when the next Share Market crash is going to happen, mostly because the fear surrounding this makes for great headlines that everyone wants to read. All this attention is currently focused on the US Dow Jones, currently trading at an all time record high level.

If you are invested in quality businesses, ie, shares, you need to think about why you are invested in these businesses. What you want from your investment is for them to make a big profit, such that they can pay a share of this profit to you as a Dividend. Most quality public companies will pay out 60% of their profit to you as a dividend and reinvest the remaining 40% into growing the business.

Imagine what your savings account would look like if you saved 40% of your earnings every year and never spent it.

Share market crashes are a short term correction in a company’s Share Price. They have nothing to do with that company’s ability to make a profit, pay 60% to you as a dividend and to keep reinvesting 40% into growing the company – all of this soldiers on regardless of a share market crash.

Share prices change every day of the working week – reason being there is a buyer and seller for your shares every day of the week. The liquidity (or the ability to turn your investments into cash) is the most beneficial and powerful attribute of investing your money into quality businesses that we call Shares.

What doesn’t change every day? The Dividends. These are paid to you twice a year, usually with tax paid to 30% and they are either maintained or increased every year. Dividends and share prices in the short term have nothing to do with each other.

In summary, I suggest that ultimately you are really invested for Income (the Dividends) and that share price will literally take care of itself. Given your investments are in capital you will never spend (you will only let yourself spend the income this capital creates), Share Market crashes are completely irrelevant to you.

So the next time a crash occurs, deploy any surplus cash you might have and take advantage of lower share prices. For you to lose all of your money in a crash, the companies you are invested in ALL have to go bankrupt. Think about what that means practically: There would be no banks, supermarkets, hospitals, pharmacies, insurance companies, medical supplies, electricity, internet, etc – this would all be gone. Do you really think this is likely to happen?

To discuss your current financial health please Contact Us Today

Jason Birch is a Representative of Skybridge Portfolios Pty Ltd (ABN 47 149 093 069) trading as Skybridge Financial. Skybridge Portfolios Pty Ltd is a wholly owned company of Skybridge Financial Pty Ltd (A.C.N 124398385) and provides financial services through its Australian Financial Services License (AFSL No 407092). This information is of a general nature only and does not take into account your objectives, financial situation or needs. Before making any decisions you need to obtain personal advice from your advisor.