Income and Share Prices

The headlines are full of drama today for financial markets after the US market fell again last night.

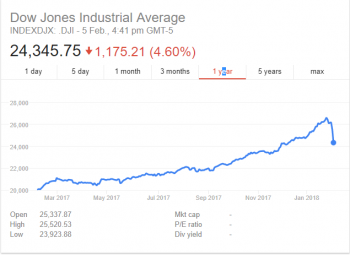

“Dow Jones plunges on Wall Street in biggest one-day loss ever”……..nine.com.au

“Stocks are getting rocked today”……Finance Insider

“Bloodbath for US stocks”……Sky News

The Dow Jones index dropped 1,175 points last night to close at 24,345 and $Billions has been lost by investors.

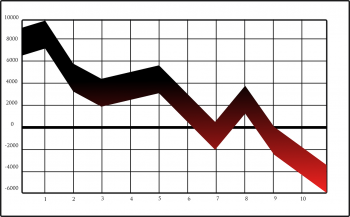

The attached graphs show the performance of the Dow Jones – one showing the past year and one showing the trend since 1980.

After viewing the graphs, I am sure you are yawning about this catastrophe as much as we are right now, the graphs show a disturbing trend of upward growth all the way through.

The capital you have invested is ultimately there to provide you an income, that’s right, income. To fund your life when working becomes optional for you.

You won’t see these headlines anywhere around the world:

Yesterday, my dividend income of $100,000 was paying me 8% of my portfolio value.

Today, my dividend income of $100,000 is paying me 9% of my portfolio value.

Tomorrow, my dividend income will still be $100,000 paying me xx% of my portfolio value.

Income doesn’t change like share prices do and make for very uninteresting headlines.

The best advice for today - seriously consider investing any spare cash you might have. Buy while quality companies are now discounted for everlasting income !!

To discuss your current financial position please Contact Us Today

Jason Birch is a Representative of Skybridge Portfolios Pty Ltd (ABN 47 149 093 069) trading as Skybridge Financial. Skybridge Portfolios Pty Ltd is a wholly owned company of Skybridge Financial Pty Ltd (A.C.N 124398385) and provides financial services through its Australian Financial Services License (AFSL No 407092). This information is of a general nature only and does not take into account your objectives, financial situation or needs. Before making any decisions you need to obtain personal advice from your advisor.